Black Heavy Duty Thick Knuckle Duster for Travellers Riders Self Knuckle Duster Ring – Big Joes Biker Rings Classic knuckles – KNUCKLEDUSTER Stainless Steel 316 Knuckles Knuckle Duster with Cubic Zirconia Pendant Real 304 Stainless Steel Knuckle Dusters Self Defense – Cakra EDC X71 Quick Open Knuckle Duster Knife – Hyper Cart Is A Knuckle Duster The Right Self Defense Weapon? Twin Flame Knuckle Duster Serpentine Silver Queen Clements knuckleduster knife Imperial War Museums Solid Steel Knuckle Duster Brass Knuckle BLACK AND GREY Knuckle duster Collections Online Museum of New Zealand Te JEWELLERY OR A $10,000 KNUCKLE DUSTER? Knuckle Duster Ring – Big Joes Biker Rings Outdoor Fitness Metal Brass Knuckle Duster Selfdefense Boxing Solid Steel Knuckle Duster Heavy Duty Steel Knuckles Beefy Johnny T's Knuckle Duster SAX Tees – SAXTEES YOU'RE NEVER ALONE KNUCKLE DUSTER – CHRISHABANA Make a Knuckle Duster or Brass Knuckles (Reupload) YouTube Apache Knuckle Duster Solid Brass Knuckle Duster SelfDefense Brass Knuckles Classic WithLoveSilver 925 Sterling Silver Fight Brass Knuckle Duster With Skull Head Ring Stainless Steel Knuckle Duster Paperweight – Cakra EDC Gadgets Pocket Slim Spiked knuckleduster Rajput Knife Knuckle Duster The Great Outdoors Warehouse 1918 US Knuckle Duster Trench Knife Atlanta Cutlery Corporation Japanese Original Design Medium Brass Knuckle Duster Charm Made Black Iron Knuckle Duster THE KNUCKLE DUSTER BOAR BRISTLE NECK BRUSH Hairdressing scissors Knuckle duster Blades and Outdoor PARACORD WRAPPED KNUCKLE DUSTER – KNIVESINDIA A Basic Guide to Knuckle Dusters for the Newbies! by Sophia Zara WORLD WAR I KNUCKLE DUSTER The “Bullet” Knuckle Duster – Hyper Cart

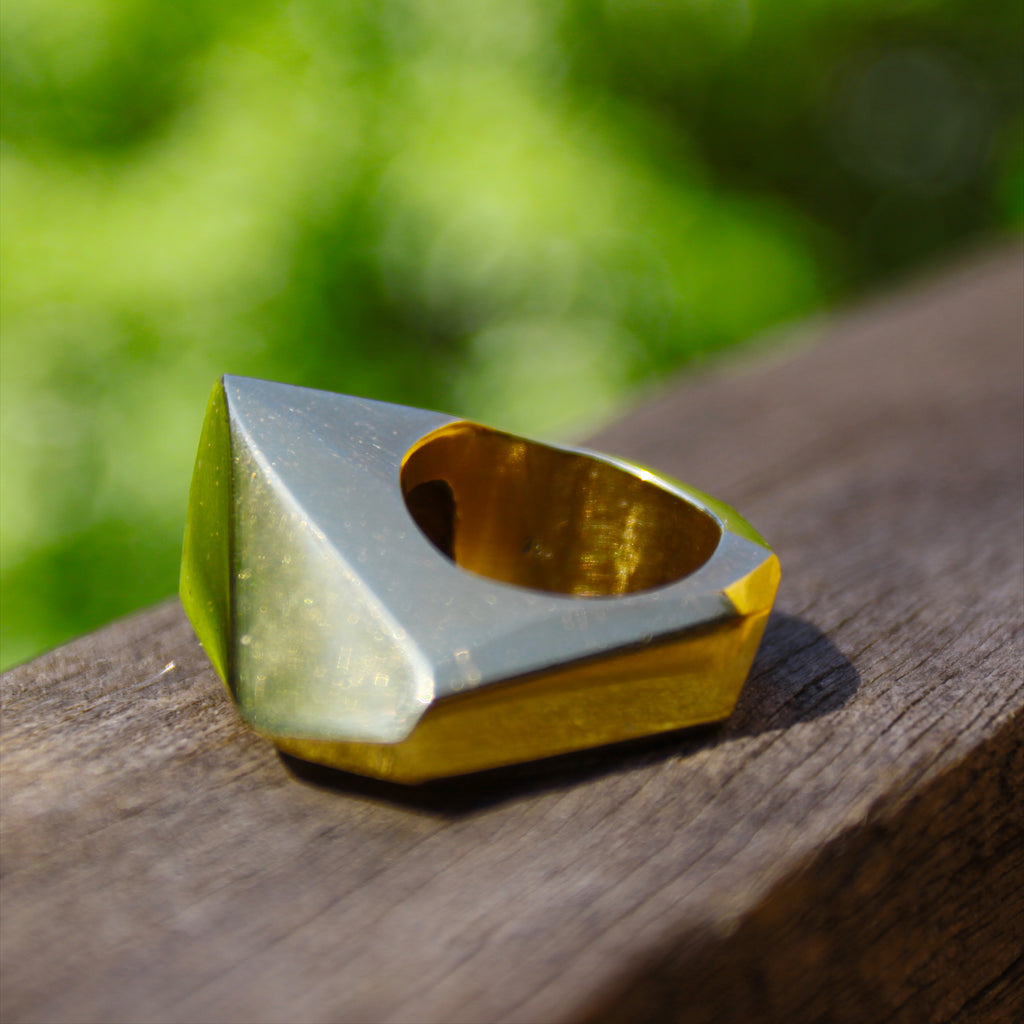

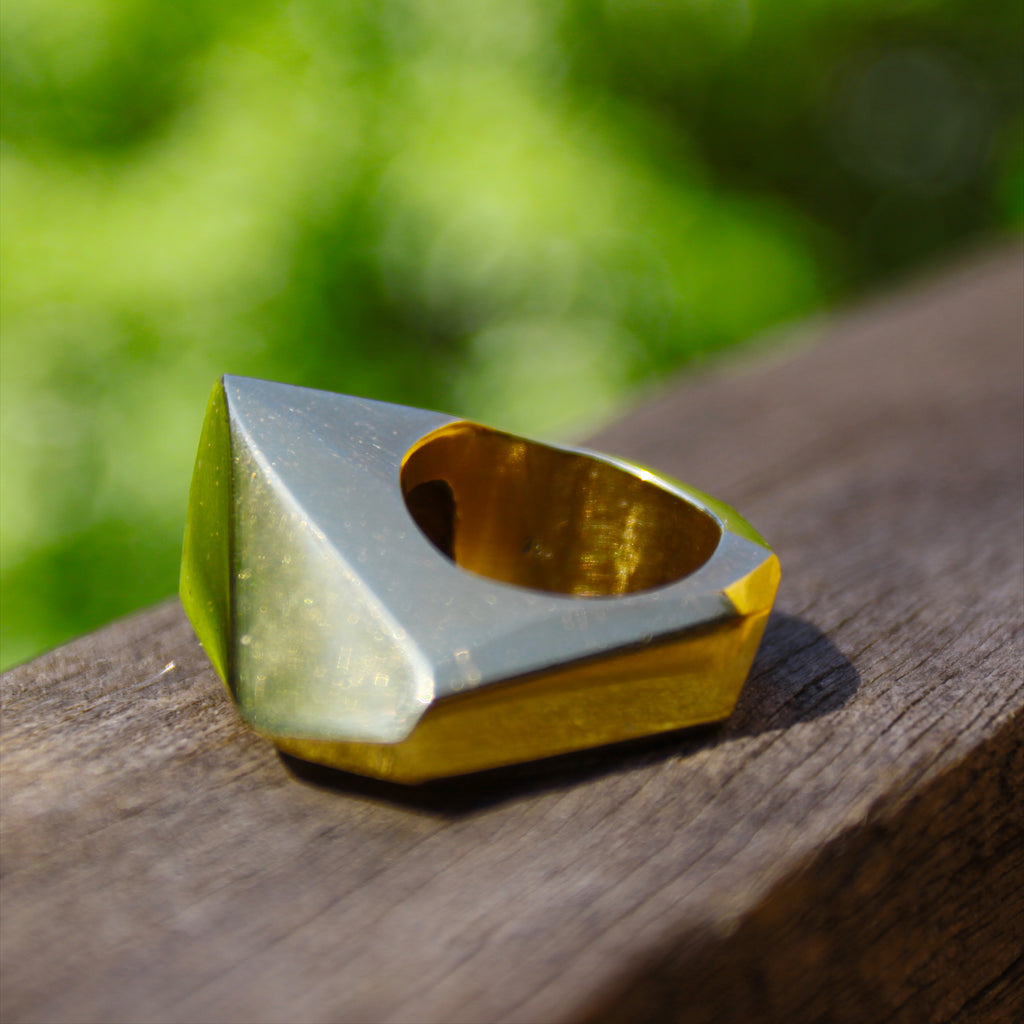

Black Iron Knuckle Duster

knuckle duster

Description

Black Iron Knuckle Duster

Information Of Products

- Category

- Brandknuckle duster

- Commodity ConditionThere is no noticeable scratches or dirt

- Shipping ChargesShipping included (paid by seller)

- Shipping MethodEasy Mercari shipping

- Days To ShipShips in 1-2 days

www.nousonomics.com

Meet the seller

f79ccf

Identity Confirmed

Speed Shipping

This seller ships within 24 hours on average

Comment (18)

355059

Other items

-

$30$21.99Hawaiian Koa Wood Knuckle Duster | KoaWood Ranch -

$38$26.99KNUCKLES KNIFE - Etsy -

$37$25.99Brass Knuckles Double Action Tactical OTF Knife MTU6SK -

$30$20.99Brass Knuckles Fighting Knife - HunterArsenal -

$29$19.99The Legal Implications of Brass Knuckles -

$32$21.99Brass Knuckles and the Law -

$43$28.99How to Use Brass Knuckles: Everything You Never Needed to Know -

$41$26.99Knuckle, Classic - DragonSports.eu -

$35$22.99Are Brass Knuckles Legal? - Firearms Legal Protection -

$38$23.99Definition & Meaning of -

$35$21.99Are Brass Knuckles Legal? - Firearms Legal Protection -

$44$26.99Brass Knuckles Legality By State 2024 -

$43$25.99Can I own a pair of wooden knuckle dusters in Kansas? From what I -

$35$20.99Amazon.com: MMA Silver Knuckles Pin : Clothing, Shoes & Jewelry -

$34$19.99amazon -

$38$21.99Amazon.com: Brass Knuckles Patch Illegal Weapon knucklebusters -

$51$28.99Brass knuckles Standard, black - AFG-defense.eu -

$49$26.99GPA26B: Compact Brass Knuckles Black -

$42$22.99Brass Knuckles for Sale Online -

$23$23.99Brass knucks hi-res stock photography and images - Alamy